Efficient vendor invoice management is essential for maintaining financial stability, fostering strong vendor relationships, managing working capital, mitigating risk, and optimizing accounts payable efficiency. That’s why many businesses turn to AP invoice automation software to centralize and streamline vendor invoice processing and payment.

Companies using SAP solutions as their primary enterprise resource planning (ERP) system often want to integrate invoice management software with their ERP. AP automation provides digital invoice capture, automated AP workflows, intelligent matching, quick exception resolution, and fast approvals.

The SAP ecosystem offers some invoice management functionality, but it’s limited in scope and constrained to specific ERP users. It is often challenging for AP professionals to use without extensive training. However, alternative solutions exist, including modern procure-to-pay software.

A SAP-integrated procure-to-pay (P2P) platform provides end-to-end purchasing, AP automation, and payment solutions while providing a seamless data flow between AP systems and the ERP, ensuring data consistency and accuracy across the business.

In this article, we explore the benefits of integrating invoice management with SAP, the risks associated with inadequate control, and the key features to look for in a robust SAP AP invoice solution.

The State of SAP Vendor Invoice Management

The SAP ecosystem offers several vendor invoice handling solutions, including SAP Ariba Central Invoice Management and OpenText SAP Vendor Invoice Management (VIM). While these solutions provide some benefits, they also have their drawbacks.

SAP Ariba Central Invoice Management is a cloud-based platform for centralizing and automating invoice processing. OpenText SAP Vendor Invoice Management is an alternative solution that provides capture, validation, and processing capabilities within the SAP environment. Both support various formats and offer some workflow automation and analytics.

It’s important to note that neither of these SAP integrations provides a complete procure-to-pay management solution. They require numerous additional components and integrations to streamline and automate standard procurement processes such as ordering, supplier collaboration, approval workflows, purchase request and purchase order generation, and more. Without these digital and automated procurement workflows in place, businesses must find alternative means of improving upstream data accuracy to reduce downstream exceptions. Otherwise, exploiting the full potential of AP automation software is impossible.

Additionally, OpenText SAP Vendor Invoice Management poses particular challenges for businesses upgrading from end-of-life systems like SAP ECC. There’s no straightforward way for VIM users to transition between SAP ECC and SAP S/4HANA without considerable disruption to accounts payable processes.

The Risks of Inadequate Vendor Invoice Management

Manual invoice processing is expensive, complex, and error-prone for midsized businesses. Most importantly, it provides inadequate control over and insight into vendor invoice management, exposing companies to risks that can have far-reaching consequences.

Financial Losses

Without proper oversight and automation, manually processing invoices can lead to duplicate payments, missed discounts, or payments made to incorrect vendors. The financial losses add up over time, eroding profitability and hindering cash flow management.

Lack of Visibility and Control

Fragmented systems, manual record-keeping, and siloed data make it challenging to track invoices, monitor payment status, and gain insights into spending patterns. Without integrated and centralized invoice management, organizations lack real-time visibility into AP and financial processes, which leads to missed opportunities for cost savings, difficulty managing supplier relationships, and increased exposure to financial and compliance risks.

Fraud and Theft

Fraudulent invoices, collusion between employees and vendors, or unauthorized payments can occur when there are weak controls. Fraudsters may exploit loopholes in manual processes, such as submitting fake invoices or manipulating payment instructions.

Without robust authentication, approval, and reconciliation measures, businesses are vulnerable to internal and external fraud schemes, which can result in significant financial losses and reputational damage.

Compliance and Regulatory Risks

Inaccurate or incomplete record-keeping, failure to adhere to tax laws, or non-compliance with auditing guidelines can lead to penalties, legal issues, and reputational damage. Ad-hoc invoice management may result in missing or improper documentation, making it difficult to demonstrate compliance during audits or regulatory investigations.

Damaged Vendor Relationships

Late payments, lost invoices, or disputes arising from manual errors frustrate vendors and lead to less favorable terms or even the loss of crucial suppliers. Vendors may perceive delayed payments or unresolved discrepancies as a lack of professionalism or financial instability, leading to strained partnerships.

Damaged vendor relationships disrupt supply chains, limit access to quality goods or services, and hinder an organization’s ability to negotiate competitive prices or favorable contract terms.

What Should You Look for in a SAP Invoice Management Solution?

When evaluating invoice management solutions for use with SAP, you should look for several key features and capabilities. Software lacking any of these is unlikely to deliver the advantages you hope for.

OCR Invoice Capture

AI-powered OCR (Optical Character Recognition) automatically extracts data from scanned or digital vendor invoices without training templates. It converts the text and numbers from the invoice image into machine-readable data, eliminating the need for manual data entry. Automating the data extraction process reduces manual effort, improves accuracy, and accelerates processing invoices.

Two and Three-Way Matching

Two-way matching compares the invoice data with the corresponding purchase order (PO) to ensure that the invoiced items and prices match the agreed-upon terms. Three-way matching goes further by including the goods receipt note (GRN) in the verification process.

Matching compares the invoice data with both the PO and GRN to confirm that the goods or services have been received before approving the invoice for payment.

Smart Invoice Coding

Smart invoice coding uses machine learning algorithms to suggest or automatically assign accounting codes, reducing manual effort and ensuring consistency. Smart coding streamlines the invoice processing workflow, minimizes coding errors, and enables faster and more accurate accounting and financial reporting.

Custom Approval and Exception Resolution Processes

Custom approval and exception resolution processes allow organizations to tailor invoice handling to their requirements. Workflows should support multi-level approval hierarchies and conditional routing based on invoice attributes such as amount, supplier, or cost center.

Exception resolution provides a structured approach to handling invoices that deviate from standard criteria or require additional review. It includes collaboration tools, escalation mechanisms, and audit trails to ensure timely exception resolution.

Duplicate Invoices and Fraud Checks

Duplicate invoice checks identify and flag invoices that have already been processed or paid, preventing accidental double payments. Fraud checks use advanced algorithms and rule-based systems to detect potential fraudulent activities, such as invoices with suspicious patterns, abnormal amounts, or unrecognized suppliers.

Straight-Through Invoice Processing

Straight-through invoice processing, or touchless processing, is the automatic end-to-end processing of invoices without manual intervention. When an invoice meets predefined criteria, such as matching with a PO and GRN, having valid coding, and falling within approved tolerance levels, it can be automatically posted and scheduled for payment without human intervention.

Straight-through processing significantly reduces manual effort, speeds up invoice processing, and improves overall efficiency. It allows accounts payable teams to focus on exception handling and higher-value tasks.

Supplier Portal

A supplier portal is a centralized hub where suppliers can submit invoices electronically and track invoice statuses, among other features. Supplier portals streamline the invoice submission process, eliminate paper-based invoices, and reduce the need for manual data entry.

Most importantly, they give suppliers transparency, allowing them to view payment status, access historical data, and communicate with the accounts payable team. Streamlined supplier collaboration can strengthen supplier relationships, reduce inquiries, and enhance overall efficiency in the invoice management process.

Invoice Management and the SAP S/4HANA Deadline

With the looming deadline for transitioning to SAP S/4HANA, businesses currently using SAP ECC face a critical decision regarding their invoice management solution. Support for SAP ECC will be discontinued in 2027, and users are expected to migrate to SAP S/4HANA before that date.

To ensure a smooth transition, businesses should adopt or migrate to an invoice management solution that integrates with both SAP ECC and SAP S/4HANA, creating a seamless transition and update that doesn’t disrupt AP workflows.

Why You Should Choose Vroozi for SAP Invoice Management

Vroozi Procure-to-Pay (P2P) offers a comprehensive solution that goes beyond SAP invoicing tools to streamline the entire procurement lifecycle. In addition to including all of the accounts payable invoice management features we mentioned above, Vroozi P2P provides a complete suite of procurement functionalities and comprehensive SAP integration via SAP BTP.

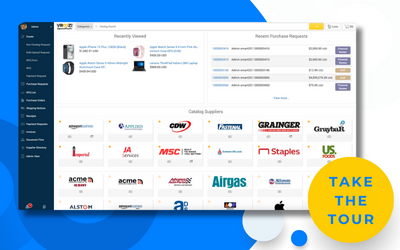

With Vroozi P2P, businesses can shop in a supplier marketplace that integrates their suppliers’ catalogs, enabling guided buying and reducing maverick spending. Vroozi’s eProcurement functionality automates purchase request generation, purchase order creation, and approval workflows.

The platform’s purchase order automation and goods receipt functionality facilitate three-way matching on a greater range of invoices. More invoices achieve straight-through processing, radically reducing manual invoice processing workloads.

By integrating a comprehensive procure-to-pay system like Vroozi P2P with SAP solutions, businesses can achieve end-to-end automation, centralization, and data integration. To see Vroozi in action, experience a live version of the app or request a personalized walkthrough from one of our team members.